Quick Contact

20th June 2019

Bula Vinaka everyone. After a tough day at the office simply saying the word Fiji is enough to make you feel more relaxed. The land of over 330 islands, all operating on the Pacific Time zone known as Island Time is one of the favourite destinations for discerning Kiwi travellers.

Only 3 hours from Auckland and home to some of the most beautiful beaches, friendly faces and colourful cocktails you’ll ever see, it’s no wonder tourists spend around $2 Billion Fijian dollars ($1.42 billion NZD) there each year. Tourism is the most important industry in Fiji and the biggest foreign exchange earner for the country, contributing approximately 17% to GDP and providing employment for over 40,000 people.

Getting the most out of your Kiwi Dollar

Passport – check. Hotel – check. Toothbrush – check. Clean undies – check. Packing and planning for your holiday is pretty straightforward but too many people forget to plan for one of the most important aspects of getting set for a trip overseas – local currency. Admittedly it’s not the most exciting aspect of travel planning, but the NZD to FJD exchange rate can have the biggest effect on your back pocket.

Failing to keep up to date with the latest in foreign exchange rates is one of the most common travel faux pas and I shudder every time I hear someone say “we’ll just exchange our money at the airport when we get there”. Unless you enjoy flushing your hard earned money down the proverbial toilet, please don’t do that.

Let’s say you were heading to Fiji last weekend (lucky you) and waited until the 16th of June to exchange $2000NZD of your hard earned to FJD. If you exchanged the same amount of NZD a week earlier, you would have an extra $75FJD in your pocket. What could that get you?

Of course the opposite can happen too. Not many things are more annoying for a traveller than seeing the currency you just exchanged drop right before your eyes. Luckily, Travel Money NZ has a trump card – Rate Guard. If you add Rate Guard to your currency purchase in store and the rate goes down within 14 days of your purchase, we’ll refund you the difference. Winning!

What does the future hold?

But how do I get the best exchange rate? That’s a very good question and it’s one that economists and travellers alike have been asking themselves since the good old spice trading days. Unless you’re a clairvoyant, there’s no exact way to predict what a currency will be valued as a future date and anyone that tells you otherwise is probably telling porky pies. Mmm porky pies.

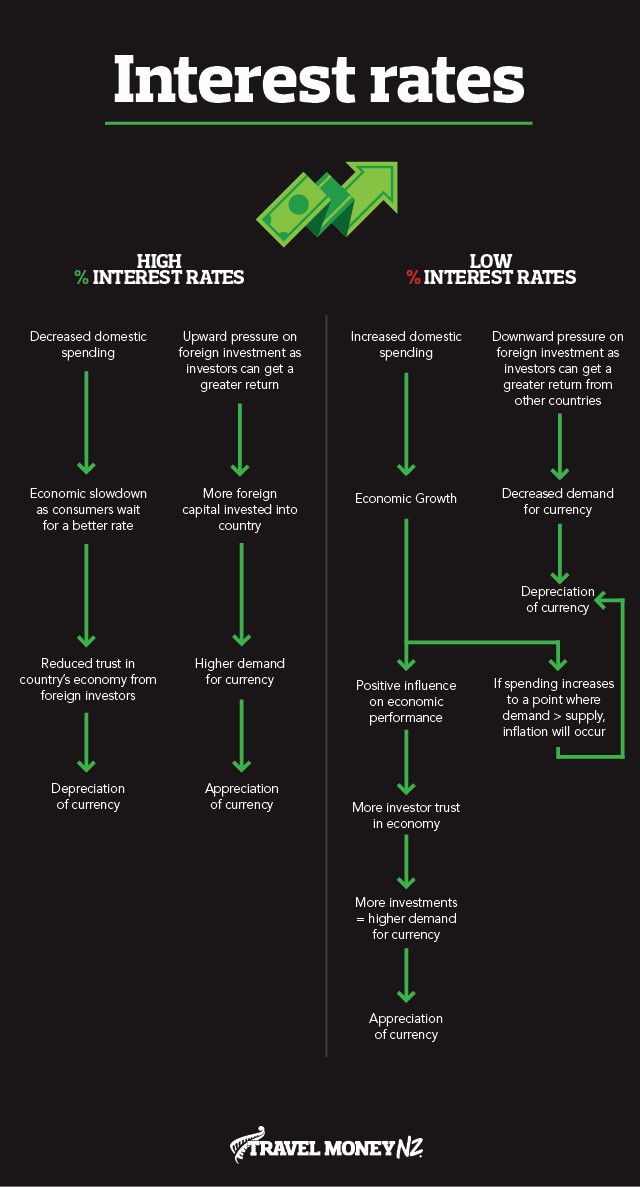

Luckily for you though, there are a number of key indicators that can be used to give you an idea of which way a currency’s value will go and we’re here to tell you all about them. Well, not all of them because I assume you don’t have 3 years to read and understand them all. Banks and financial institutions draw on a wide range of information to make their forecasts, such the Australian and Fijian interest rates, economic growth, commodity prices, political movements and pure speculation.

Before we get to some of the major influencing factors on foreign exchange rates, strap in for a crash course on the most commonly used terms in the currency business:

Appreciation: when the value of one currency increases relative to another. E.g. If the NZD went from 1.39FJD to 1.43FJD it has appreciated (everybody say Yay!)

Depreciation: On the flip side, this is when the value of a currency decreases relative to another. E.g. If the NZD went from 1.43FJD to 1.39FJD it has depreciated (boo)

Higher valued currency: cheaper imports (no more abandoning that online shopping cart), more expensive exports and extra spending money abroad.

Lower valued currency: more expensive imports, cheaper exports (more people overseas drinking our Sav Blanc) and less cash for your Fijian getaway.

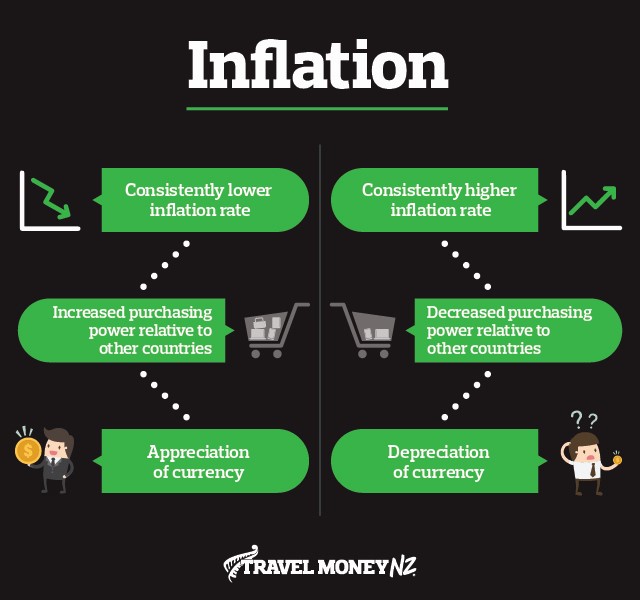

Inflation: The rate at which the general level of prices for goods and services is rising and, in turn, a currency’s purchasing power is falling. In other words, $10 back in the day used to get you a lot more than it does now - over time the value of a currency decreases as a result of supply and demand.

Economic growth: The increase in an economy’s capacity to produce goods and services. Growth is generally good, but we don’t want it to be too fast.

Now let’s move onto the heavy stuff that plays with currencies like puppets.

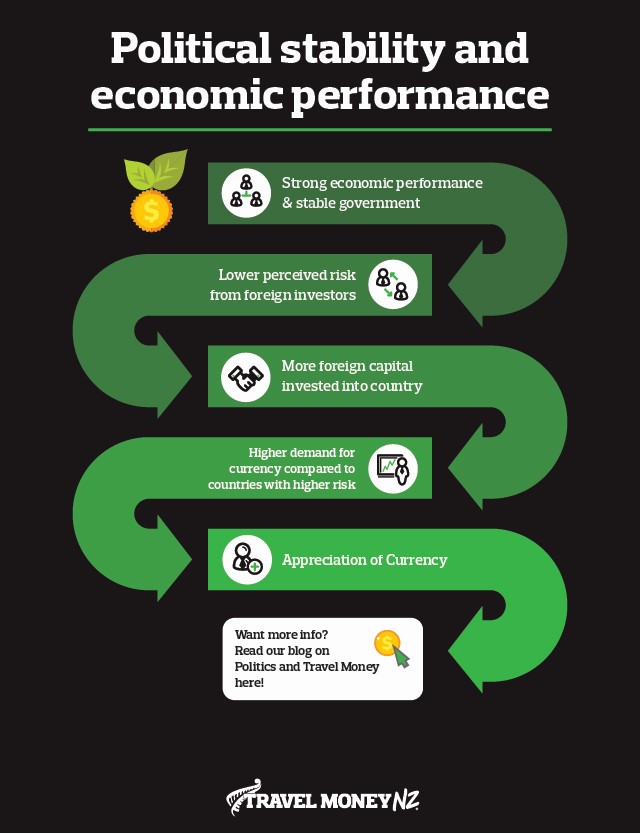

Still with us? The main takeaway here is to remember that a lot of factors influence foreign exchange rates and it’s important to stay abreast of the hip hop happenings in the country you are travelling to in the months leading up to your trip. Better yet, you could sign up for currency alerts and let us do the hard work for you. Any change in the environmental landscape such as a new trade agreement, catastrophic weather event, change in leadership or even a news article can cause the public to gain or lose trust in the economy. In turn, this can put pressure on the FJD.

More trust = more people willing to invest in country = greater demand for currency = appreciation

Less trust = less foreign capital invested into country = decreased demand for currency = depreciation

From a traveller’s perspective, we don’t have much control over how the NZD will perform against the FJD and are at the mercy of the currency Gods. However, understanding forecasting and planning ahead can give you more bang for your buck in Fiji. Be sure to keep an eye on forecasts and changes in the rate, as the predictions of large institutions will change as the financial landscape does too.

*Keep in mind prices may vary across states and individual vendors. Cost and quantity estimations should be used as a guide only. This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.