Quick Contact

20th June 2019

The Chinese currency is one that has a habit of confusing travellers. The National Currency is the Yuan (CNY) however, officially it’s known as the Renminbi (RMB) which translates to The People’s Currency. Not too complicated so far, but there are two kinds of Chinese Yuan: onshore which is the CNY abbreviated version and offshore which is shortened to CNH.

Onshore Yuan trading is controlled by the People’s Bank of China (PBOC) while the offshore Yuan trades freely on foreign currency markets. This means that the Yuan (CNY or Renminbi) inside of China is a totally different currency to the Yuan traded outside of China (CNH), with each trading at their own separate buy, sell and mid-market rates. If that wasn’t enough to make your head spin, while travelling in China, you’ll probably hear people refer to the Yuan as "kuai," pronounced “kwai”, which is the local word for Yuan.

If you need a lie down after all that I don’t blame you.

Enough with the crash course in currency confusion, what do the economic boffins at big bank HQs have to say about the upcoming value of the CNY vs the NZD?

NZD to CNY forecast

As you can see, there is some disparity between the big banks in forecasting exactly what the Yuan will do in the upcoming months. Due to the lower cost of living in China, the 200CNY difference between the Westpac and ANZ forecast alone would get you an extra:

How do banks forecast the value of the NZD/CNY?

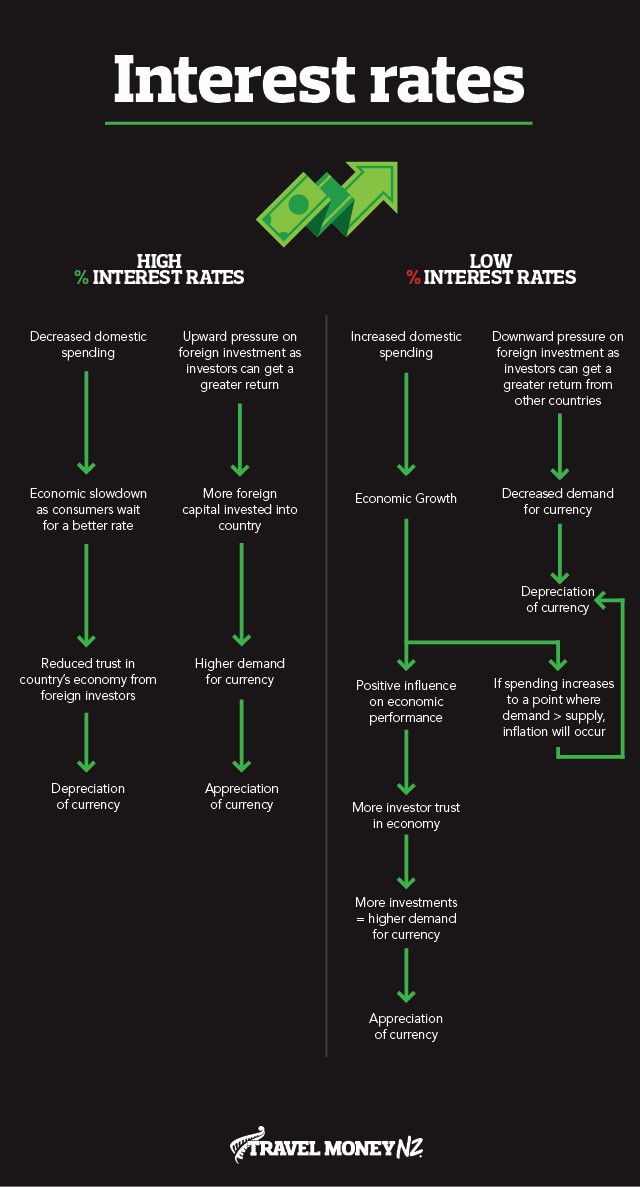

This is where things get really tricky. Which factors are helpful in predicting the future exchange rates? There are countless streams of data and methods of analysis, none of which are fool proof enough for economists to solely rely on, so we suggest taking a holistic view of the macroeconomic fundamentals and scoping out a number of NZD/CNY forecasts before making up your mind.

One of the biggest forecasting factors at the moment on top what we’re about to go into below is the US/China Trade War. Unless you’ve given up TV, the internet, newspapers and smoke signals altogether chances are you’ve at least heard the term. You can talk about economic fundamentals and technical signals until you’re blue in the face but sometimes it’s good old fashioned political manoeuvring and perceived future instability (take a look at Donald Trump’s tweets for example) that has the biggest effect on a currency’s value.

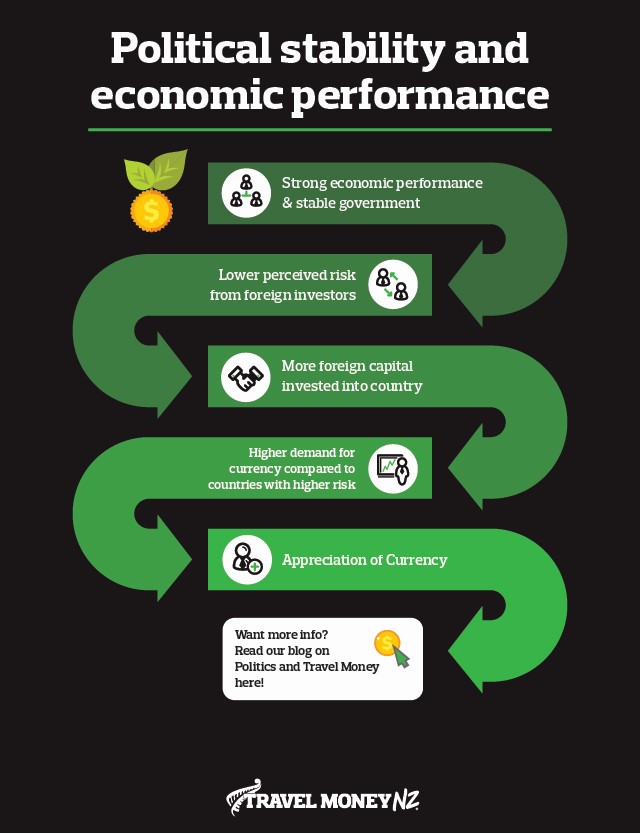

Any change in the environmental landscape such as new trade tariffs, trade deals, catastrophic weather events, change in leadership (highly unlikely in China) or even a poorly timed Tweet can cause the public to gain or lose trust in the economy. In turn, this can put pressure on the CNY. Think of it like this:

More trust = more people willing to invest in country = greater demand for currency = appreciation

Less trust = less foreign capital invested into country = decreased demand for currency = depreciation

With that in mind, let’s take a look at some of the commonly used definitions at play in currency forecasting:

Appreciation: when the value of one currency increases relative to another. E.g. If the NZD went from 4.5CNY to 4.75CNY it has appreciated (this means more Kung Pao chicken all round).

Depreciation: is when the value of a currency decreases relative to another. E.g. If the NZD went from 4.75CNY to 4.5CNY it has depreciated.

Higher valued currency: cheaper imports (no more abandoning that online shopping cart), more expensive exports and extra spending money in China.

Lower valued currency: more expensive imports, cheaper exports and less cash for your Chinese sojourn.

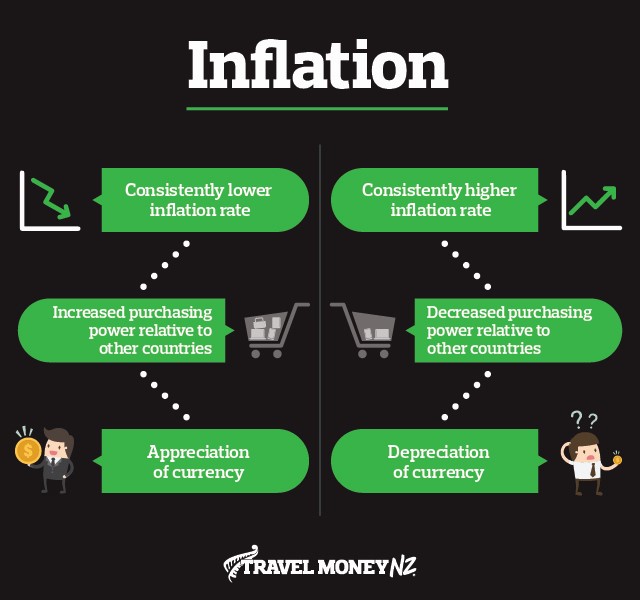

Inflation: The rate at which the general level of prices for goods and services is rising and, in turn, a currency’s purchasing power is falling. In other words, $10 back in the day used to get you a lot more than it does now - over time the value of a currency decreases as a result of supply and demand.

Economic growth: The increase in an economy’s capacity to produce goods and services. Growth is generally good, but we don’t want it to be too fast.

Now let’s move onto the really heavy stuff and how it affects foreign exchange rates.

We weren’t lying when we said a lot goes into forecasting foreign exchange rates and the sheer volume of data means there is a higher margin of error. Think about how accurate a meteorologist is at predicting the weather tomorrow vs a random day 6 months down the track. This doesn’t make foreign exchange forecasting less valuable, it just means we need to consider all sides before making an educated guess.

Staying on top of all of these factors is borderline impossible, but you can take the hard work out of it by signing up to Travel Money NZ’s rate alerts and let us do the hard work for you. On top of that, not much is more disheartening for a traveller than seeing the currency they just purchased drop in the days after spending their hard earned cash. Take that risk out of the equation and potentially put some extra Yuan in your sky rocket by adding Rate Guard (for free) to your currency purchase in store and if the rate goes down within 14 days of your purchase, we’ll refund you the difference. Now that’s what I call money for nothing, literally!

*Prices are approximations based of the difference between mean estimates for NZD to CNY in Q3 2019 and Q4 2019. Keep in mind prices may vary across states and individual vendors. Cost and quantity estimations should be used as a guide only. This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.