Quick Contact

17th June 2019

In July 2017, the average NZD to JPY exchange rate was $1 to ¥82.709 ^. Sadly for those looking to venture to the land of sushi and Sumo wrestlers soon, the exchange rate has dropped and is currently circulating around the $1 = ¥75 mark.

This is where being able to predict the future would come in handy. Last year, if you had exchanged $2,000 NZD to JPY at $1 to ¥85.54, you could’ve scored an extra ¥11,900 for you holiday. That equals a lot of extra sashimi.

According to the Bank of New Zealand forecast, if you can hold out on purchasing your Yen until Dec 2019, it is predicted that you’ll pocket an extra ¥2,000. What will this mean for your travels? To answer this we’ve put the number into more important terms, food.

NZD to JPY Exchange Rate Forecasts:

If those extra meals aren’t worth learning a bit about forecasting then I don’t know what is.

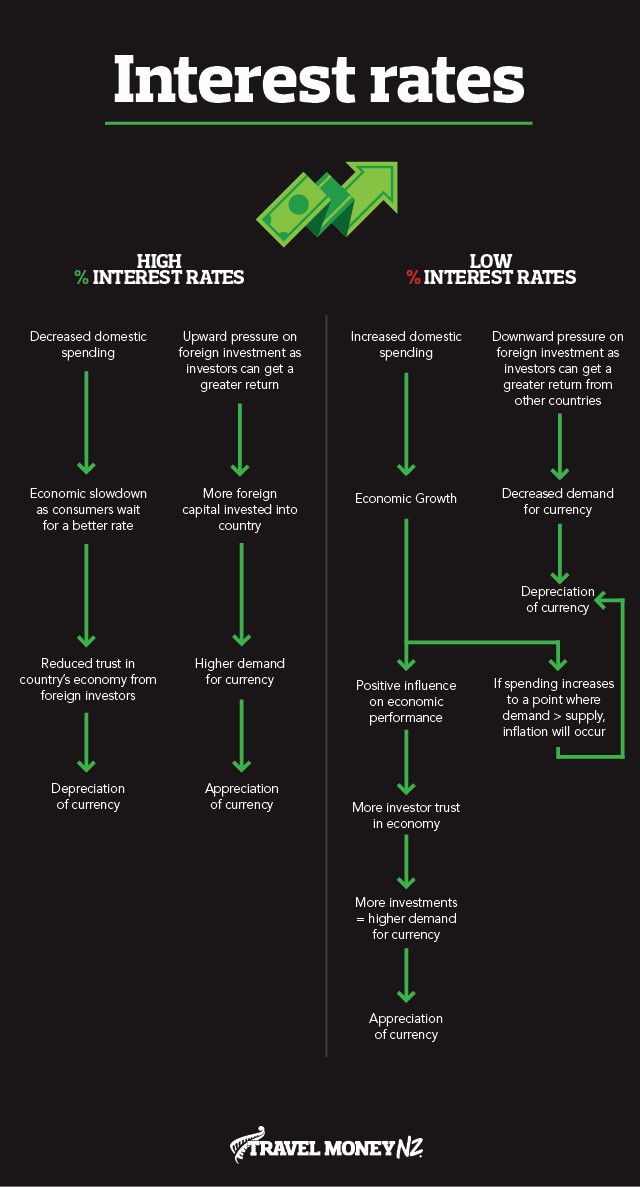

Just from the differences in these predictions, it is obvious that forecasting can be highly variable. Banks and financial institutions draw on a wide range of information to make their forecasts, such the New Zealand and Japanese interest rates, economic growth, commodity prices and speculation. There are countless streams of data and methods of analysis, none of which are 100% accurate. Therefore, in order to lower risk and more accurately forecast, it is recommended that you look at a couple of different NZD to JPY forecasts before you purchase your travel money.

To get a deeper insight into forecasting, it’s important to have an understanding of the relationship between macroeconomic fundamentals and exchange rates. Below we have compiled a quick lesson on these fun topics to help you get better informed before you stock up on Yen.

Lesson 1: Definitions

Appreciation: When the value of one currency increases relative to another. E.g. if the NZD went from ¥80 to ¥85, it has appreciated. This means you can treat yourself to that extra sushi roll

Depreciation: (Hint, it’s the opposite) When the value of one currency decreases relative to another, e.g. if the NZD dropped from ¥85 to ¥80. This means being a bit stingy on the sushi.

Higher valued currency: This means we have a strong Kiwi dollar, which equals cheaper imports, more expensive exports and extra spending money in Japan.

Lower valued currency: This means we have a weaker Kiwi dollar, which equals more expensive imports, cheaper exports and less cash for Japan.

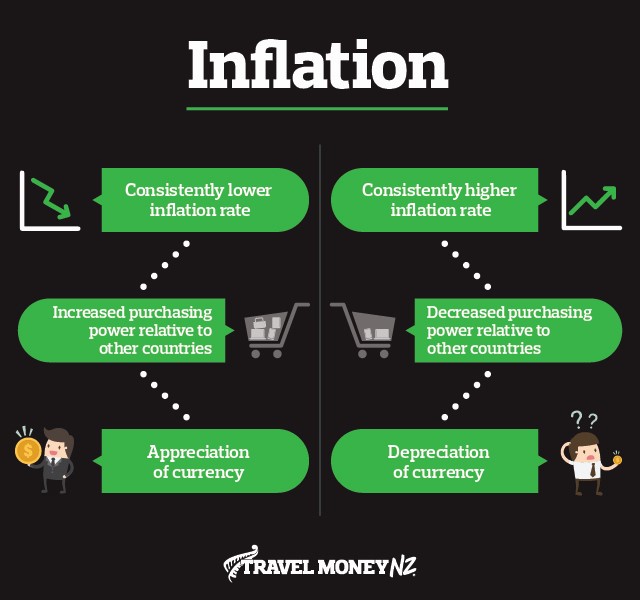

Inflation: The rate at which the general prices of goods and services is rising, and in turn, the rate at which a currency’s purchasing power is falling. Back in the day, $10 used to get you a lot more than it does now, because over time the value of currency decreases due to supply and demand.

Economic growth: The increase in an economy’s capacity to produce goods and services. Growth is generally good, but we don’t want it to be too fast.

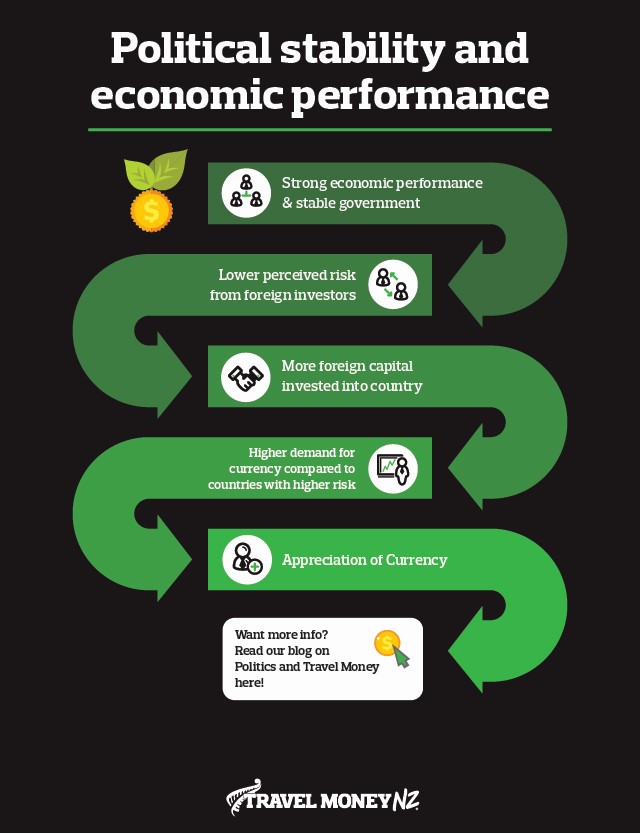

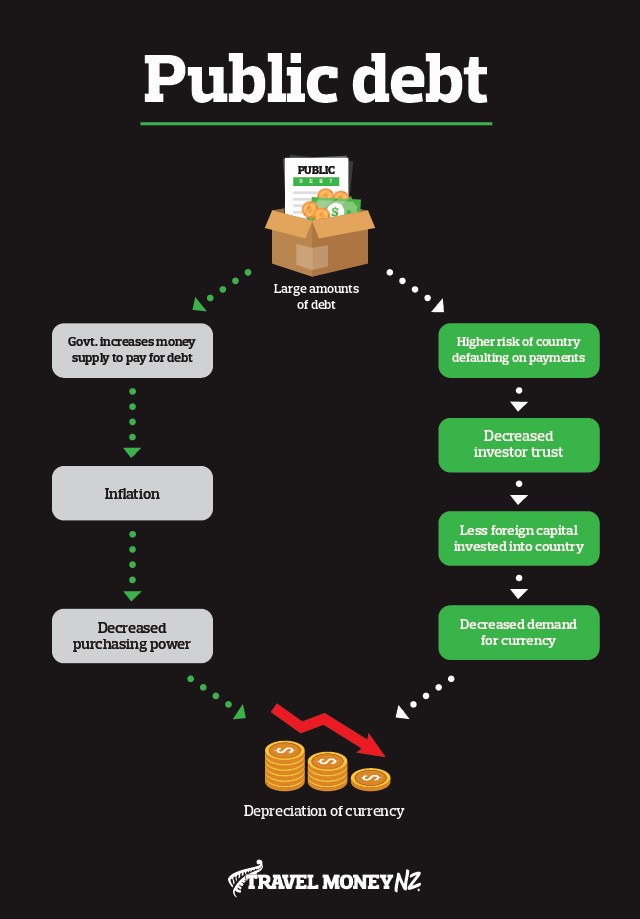

Now for lesson 2: Let’s have a look at some flow charts!

The main takeaway is that the NZD and JPY exchange rates are influenced by a variety of different factors. All in all, they sum up the supply and demand of the currency.

Demand is driven by the perceptions of a currency’s value, which is influenced by economics, politics and the media (among other things).

It’s also important to note that the changes are relative to the other country in which the currency is being compared to. Elements in both currencies influence and interact with each other, so they must be considered all together for a holistic view.

Therefore, if you’re planning a trip to Japan, it’s wise to keep an eye on what’s going on over there. Any change in the environmental landscape such as a new trade agreement, change in leadership or even a news article can cause the public to gain or lose trust in the economy. In turn, this can put pressure on the JPY.

More trust = more people willing to invest in country = greater demand for currency = appreciation

Less trust = less foreign capital invested into country = decreased demand for currency = depreciation

From a traveller’s perspective, we don’t have much control over how the NZD will perform against the JPY. However, understanding forecasting and planning ahead can give you more bang for your buck in Japan. Be sure to keep an eye on forecasts and changes in the rate, as the exchange rate might be set to improve. It's also worth having a squiz at our New Zealand dollar exchange rate forecasting blog to see what's affecting the NZD side of things.

Don’t worry about missing out on a better rate after purchase either! Add Rate Guard in store and we will refund you the difference should the rate change within 14 days after purchase.

*Prices are approximations based off the difference between mean estimates for NZD to JPY in Q1 2019 and Q2 2019. Keep in mind prices may vary across states and individual vendors. Cost and quantity estimations should be used as a guide only. Rates advertised are market rates and are not available to the general public. ^Average exchange rates for 2018: data sourced from the Westpac Financial year average exchange rates report. This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.