Quick Contact

17th June 2019

Visiting the UK and updating your profile picture to a candid of you in a classic red phone booth seems to be a rite of passage for many Kiwi travellers.

Another key part of this coming-of-age journey is seeing your travel money halved as you convert New Zealand Dollars into Great British Pounds. Just like your spending money, a fair bit of your soul disappears out of shock and despair as you head onto a 14 hour flight with significantly less money then you had budgeted.

This feeling becomes even worse when you realise a little bit of planning could have allowed you to capitalise on a better NZD to GBP exchange rate, or that you could have signed up to rate alerts and been notified when the NZD /Pound was at high.

Jeez, this has taken a sad turn…

Well, friends, it’s time to stop the pity party and take matters into your own hands. There are a number of forecasts available to travellers to help plan and understand upcoming currency exchange movements. Take the below table as an example. It highlights NZD to GBP forecasts for the next 2 peak UK travel seasons.

NZD to GBP Exchange Rate Forecasts:

As you can see, exchanging in Sep 2019 could get you more than in Dec 2019 in both instances. Taking this example, whilst 20 pounds might not sound like much, it would be silly to turn down even the smallest amount of extra spending money.

How do banks predict exchange rates?

How long is a piece of string? The simple answer to both of these questions is that there is no simple answer.

Financial institutions draw on a wide scope of information sources and methods when forecasting the New Zealand dollar against the pound. The fluid nature of these data streams, combined with a rapidly changing global climate, means none of the methods are locked, loaded and ready to rely on. So, just like you would compare a few hotels before booking in ol’ London town, we recommend comparing a few New Zealand dollar to pound forecasts when planning the best time to purchase travel money.

We understand that looking at exchange rate predictions isn’t a task that would get you super excited (unless you work in economics or finance, if that’s the case then party time). With that in mind, we have done the hard work for you and explained some key terms behind predictions into a language travellers can understand. So, sit back with an English breakfast and prepare to impress your friends with your newfound knowledge.

Lay the foundations of your knowledge with these definitions.

Appreciation: When the value of one currency increases relative to another. E.g. If the NZD went from 0.501 GBP to 0.511 GBP, it has appreciated (cheers to more pints at the pub).

Depreciation: The value of a currency decreases relative to another. E.g. If the NZD went from 0.511 GBP to 0.501 GBP, it has depreciated (less money to spend in the Harrods gift shop).

Higher valued currency: cheaper imports (that Royal Wedding memorabilia is cheaper #winning), more expensive exports and extra spending money in the UK.

Lower valued currency: more expensive imports, cheaper exports (more Brit’s wearing scarves made from NZ wool) and fewer pounds in your back pocket.

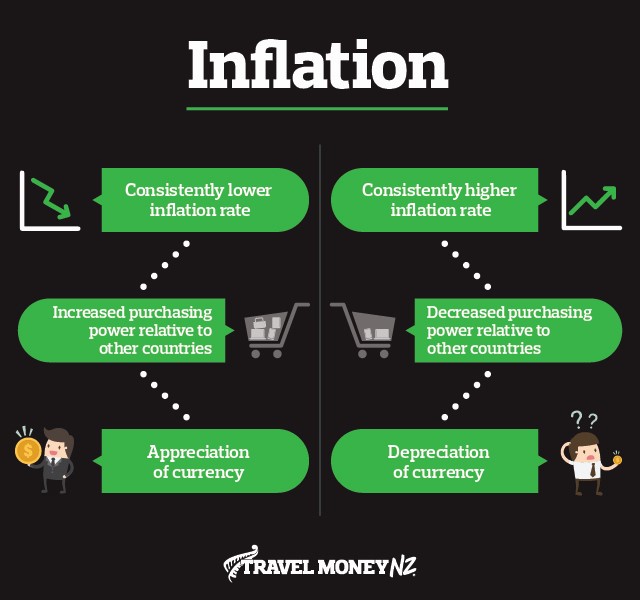

Inflation: The rate at which the general level of prices for goods and services is rising and, in turn, a currency’s purchasing power is falling. Back in the day a freshly baked loaf of bread used to cost 50 cents, now we pay $3 to indulge in a gluten-free loaf that lacks flavour and adds a layer of sadness to your meal (gluten is a delicious devil).

Economic growth: The increase in an economy’s capacity to produce goods and services. Growth is generally good, but we don’t want it to be too fast. Good growth is like using training wheels for a month or so before graduating to your big kid bike. Bad growth is the equivalent of chucking a newborn on a bike without a helmet and hoping for the best.

Still with us? Stay strong, we’re hitting the good stuff now.

When interpreting this data for a GBP to NZD forecast, you must also consider the following:

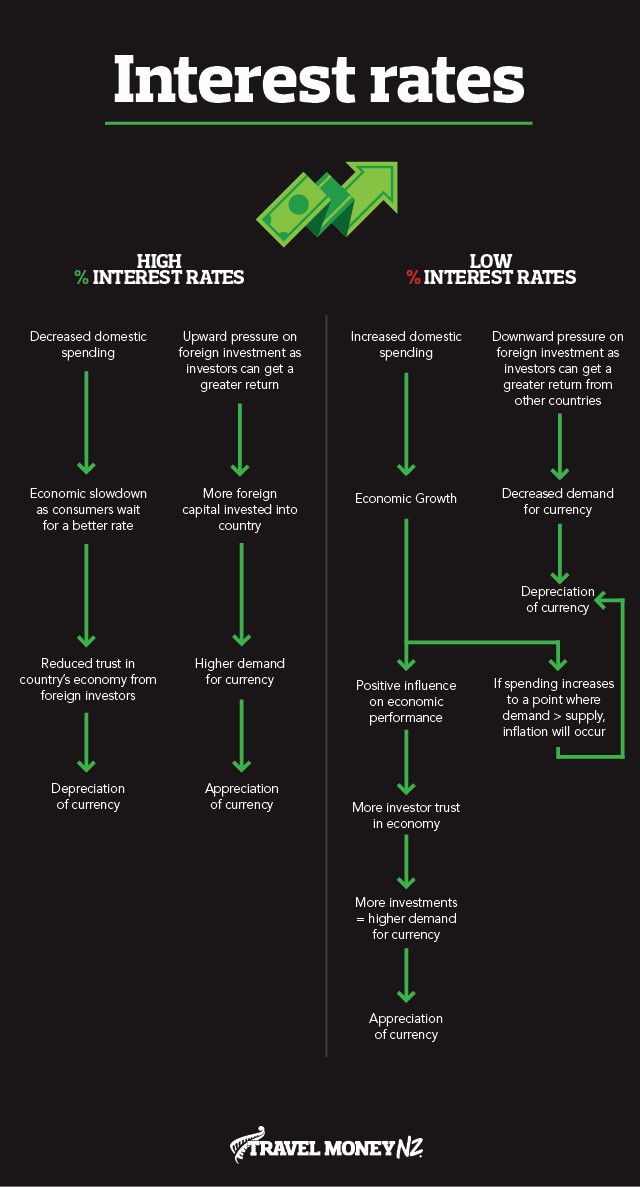

- Exchange rates are influenced by a host of factors that interact and influence each other internally. However, they ultimately sum up the supply and demand of a currency in an easy to measure metric.

- Demand itself is driven by market psychology, or people’s perception of the currency’s value. This perception is not just influenced by economics, but also politics and the media (just to name a few!).

- Changes in a currency are relative to changes in the currency of which it is being compared to. So, in this instance, factors that influence the pound must be considered alongside the dynamic of the New Zealand dollar and the NZ economy to get a truly holistic view.

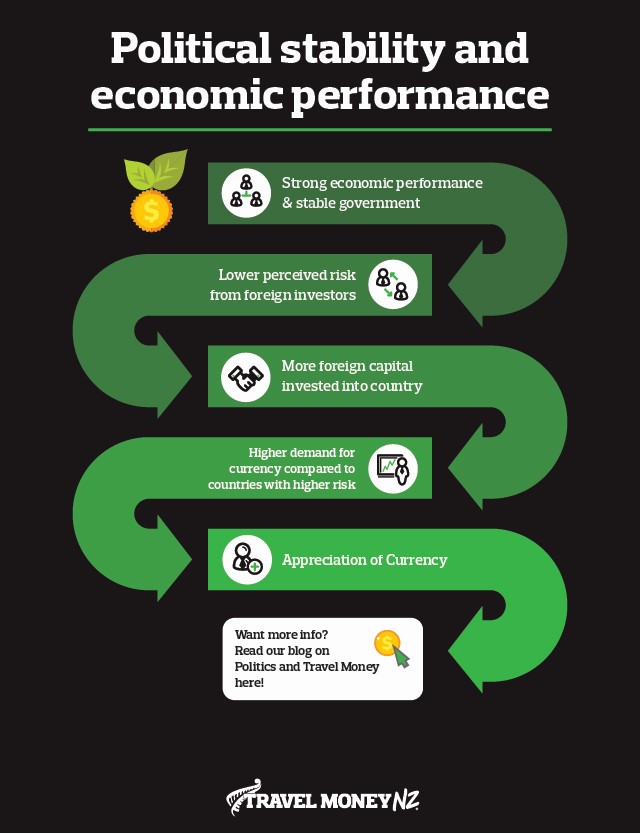

The pound is a great example of how political uncertainty and the resulting lack of investor trust can quickly depreciate a currency.

Unless you have been living under a rock for the past three years, you would no doubt have heard about Brexit, or the UK’s exit from the European Union. Investors feared leaving the UK would result in a weaker pound (a.k.a less return on their investment). This lack of trust and resulting lack of/ withdrawing of investment saw the pound depreciate by over 9.2% against the Aussie dollar in the space of a week.

While this wasn’t ideal for the UK, Kiwi travellers were cheering as they were able to cash in on record NZD to GBP exchange rates.

As Brexit negotiations are still taking place, they will definitely have an impact on the value of the pound. So, if you are planning a trip to the UK in the next two years we definitely recommend you keep an eye on Brexit news, as well as some currency forecasts, to ensure you a purchasing at an ideal time.

Better yet, sign up for currency alerts and let us do the hard work for you. It’s also worth adding Rate Guard to your transaction (it’s free!) and we will refund you the difference should the rate improve within 14 days of purchase. Who knows, it might give you those 4 extra pints we mentioned above.

*Prices are approximations based of the difference between mean estimates for AUD to GBP in Q1 2019 and Q2 2019. Keep in mind prices may vary across states and individual vendors. Cost and quantity estimations should be used as a guide only. Rates are market rate and are not available to the general public ^Average exchange rate for 2018 data sourced from the Westpac Financial year average exchange rates report. This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.